- Manual Memo records include additional information. This additional information involves e.g. incoming and outgoing payments that do not trigger actual postings in Cash Management.

-

Format Tree - Based on a XML schema the included nodes, technical elements or segments describe how the information from the SAP S/4HANA system is filled in each of the tree fields. The system is thereby able to map information from the invoice (e.g. the amount) to the correct field of the format tree. There is also the possibility to include technical fields and calculations or constant values in such a format tree.

- ISO 20022 Standard - a The CGI XML formats, offer the possibility to overcome the beforementioned challenges. One format tree fits several banks and can be used worldwide with a different bank.

- Operational Chart of Accounts - The operational chart of accounts is the one that is being used on an operational level. The accounts of this chart of accounts are the ones that the accountants use when posting documents. It is assigned on the company code level. The use of this chart of accounts is mandatory.

- Country Chart of Accounts - The country chart of accounts is used if a company needs to use other accounts than the ones used in the operational chart of accounts in order to fulfil local accounting standards. Usually, there is a 1:1 relationship between the accounts from the operational chart of accounts and the accounts from the country chart of accounts. It is assigned on a company code level. The use of this chart of accounts is optional.

- Group Chart of Accounts - The group chart of accounts is used in order to deliver financial statements to consolidation. Reasons to use this chart of accounts might be that different companies within the group might use different operational charts of accounts or that accounts within the operational chart of accounts should be aggregated for consolidation. Therefore, there is usually an n:1 relationship between the accounts from the operational chart of accounts and the accounts from the country chart of accounts. It is assigned directly to another (usually an operational) chart of accounts. The use of this chart of accounts is optional.

CONFIGURING GROUP REPORTING WITH S/4 HANA 1909

|

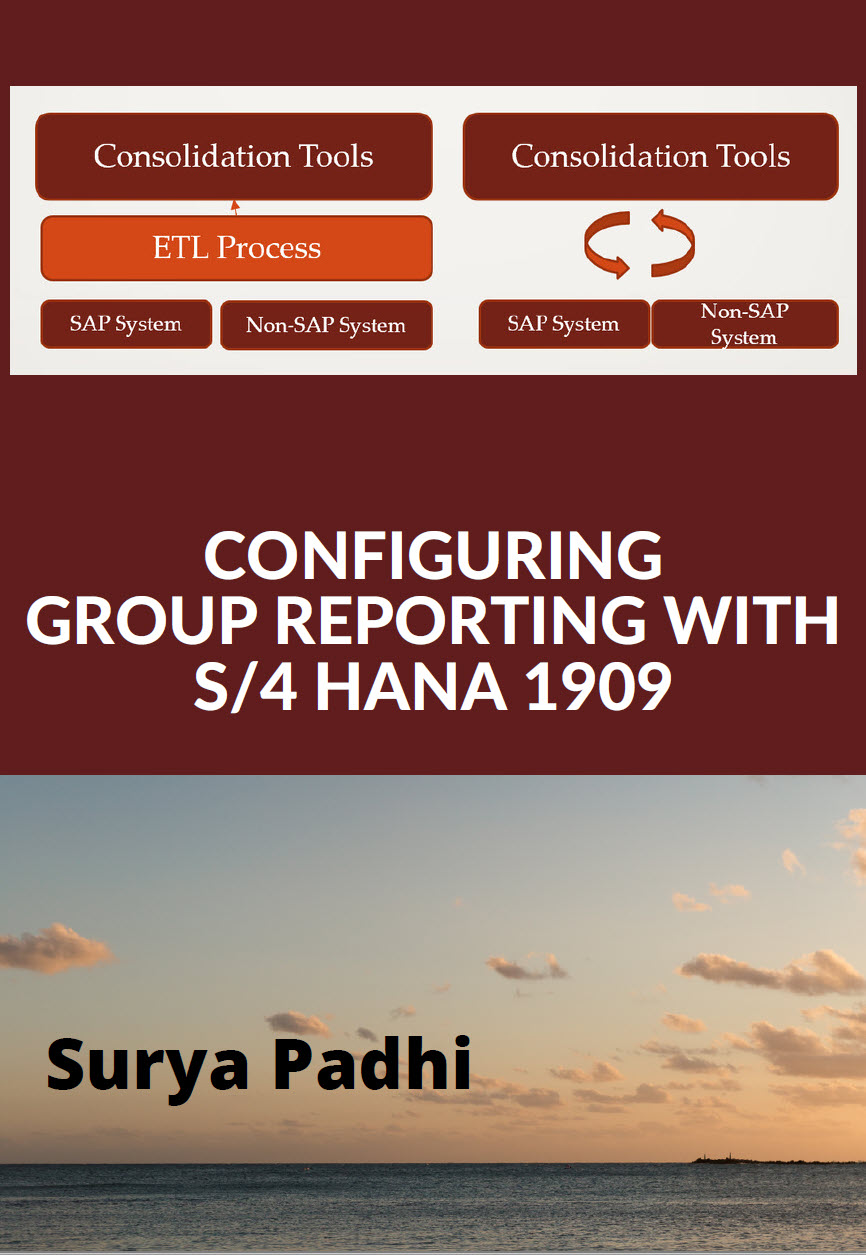

With S/4 HANA Finance 1809, SAP has introduced group reporting, a SAP’s consolidation solution. Group reporting’s innovations expose the new consolidation solution, which is a hybrid of SAP’s EC-CS, BCS and BPC functionalities. You’ve heard about Universal Journal, single source of truth, real-time processes, and UI improvements, in group reporting, you can leverage all these functionalities without additional acquisition of the software cost. SAP group reporting facilitates continuous accounting and consolidation process in a single instance, thus reduces the financial closing manhours. With the tight integration of ACDOCA table and flexible upload functionalities help smooth transition of consolidation unit’s local data to consolidation data for financial consolidation. With the S/4 HANA 1909 release, SAP enhanced group reporting functionalities with new fire tiles. Configuring Group Reporting with S/4 HANA 1909 covers end to end solution with one complete consolidation of financial statements of integrated and non-integrated units. Highlights of Configuring Group Reporting with S/4 HANA 1909:

|

| Available at following Amazon Market Place Amazon.com | Amazon.co.uk | Amazon.de | Amazon.fr | Amazon.es | Amazon.it | Amazon.nl | Amazon.co.jp | amazon.in | Amazon.ca | Amazon.com.br | Amazon.com.mx | Amazon.com.au |

|

- Financial Statement Versions - To meet the various reporting requirements, various financial statement versions can be created in the SAP system. In these financial statement versions, you define exactly which accounts are to appear in which line items of the financial statement. Many financial statement versions are included in the SAP system.

- Reconciliation accounts - Reconciliation accounts link the sub-ledgers to G/L Accounting in real-time. As soon as a posting is made to a sub-ledger account, the same posting is made to the respective reconciliation account in G/L Accounting.

- Activity-based - Activity-based costing analyzes cross-departmental business processes. The goals of the whole organization and the optimization of business flows are prioritized. In contrast to the responsibility and function-oriented basis of CO-OM-CCA, activity-based costing provides a transaction-based and cross-functional approach for activity output in which several cost centres are involved. The emphasis is not on cost optimization in individual departments, but the entire organization.

- Product Cost - Product Cost Controlling calculates the costs that occur during the manufacture of a product or provision of a service. It enables you to calculate the minimum price at which a product can be profitably marketed.

- Profitability analysis -Profitability analysis analyzes the profit or loss of an organization by individual market segments. The system allocates the corresponding costs to the revenues for each market segment. Profitability analysis provides a basis for decision making, for example, for price determination, customer selection, conditioning, and for choosing the distribution channel.

- Operating concern - The operating concern is the highest reporting level for profitability and sales and marketing controlling, and the central organizational unit in Profitability Analysis (CO-PA) used to segment and structure the market.

- Controlling areas - Controlling areas structure the internal accounting operations of an organization within Management Accounting. They represent closed units that are used to calculate costs. All internal allocations relate solely to objects that belong to the same controlling area.

- Company codes - Company codes are independent accounting units within Financial Accounting. They represent the smallest organizational units for which an account group can be set up for the purposes of external reporting. The process of external reporting involves recording all relevant transactions and generating all supporting documents for financial reports (such as balance sheets and profit and loss statements).

- Profit Centers -Profit Centers are organizational units in accounting that reflect a management-oriented structure of the organization for the purpose of internal control. You can analyze operating results for profit centers using either the cost-of-sales or the period accounting approach. By calculating the fixed capital as well, you can use your profit centers as investment centers.

- Accounts Receivable - The Financial Accounting (FI) sub-ledger Accounts Receivable records and administers accounting data of all customers. It is also an integral part of sales management. The system records all postings in Accounts Receivable directly in the G/L. The system updates different G/L accounts depending on the transaction involved for example, receivables, down payments, and bills of exchange.

- Business Partner Role - A business partner can have several roles, such as a contract partner (FI-CA), FI Vendor (FIAP),

FI Customer (FI-AR), Customer (SD), Supplier (MM), prospect (potential customer), or business partner (general). In general, a Business Partner (BP) role corresponds to a business context in which a business partner can appear and provides the application specific data.

- Business Partner Category - The Business Partner category is the term used to classify a BP as a natural person (for

example, a private individual), group (for example community of heirs), or organization (legal entity or part of a legal entity, such as a department of a company). The business partner category determines which fields are available for data entry.

- Business Partner Grouping - Each BP has to be assigned to a grouping when you create the BP. The grouping determines

the number range (external/internal). You cannot change the assignment afterwards. You can define the groupings, their descriptions, and the associated number range in customizing.